Support

debit Mastercard® FAQ

Have questions about your new debit Mastercard? Find your answers here! Below you’ll find answers on getting a card, limits and fees, card usage and more. If you have a question that is not answered here, please contact our Member Contact Centre or visit your local branch and we’ll be happy to assist you.

General questions

Your MEMBER CARD® is now a debit Mastercard product that allows you to do more. It can be used to make purchases online1, in-store locally and wherever Mastercard is accepted world-wide. Which means you can use debit Mastercard anywhere you would use Mastercard while travelling. Any purchases made with your new debit Mastercard are paid directly from your personal chequing account just like your previous MEMBER CARD.

No, the debit Mastercard is a debit card that can be used where Mastercard is accepted (online1 and internationally). Any purchases made with the debit Mastercard are paid with funds you have in your personal account. Therefore, you must always ensure you have sufficient funds in your account when making purchases.

No, all debit card MEMBER CARDS will be replaced with a debit Mastercard.

All members have access to the debit Mastercard no matter their age. However, members under the age of 12 must have a parent or guardian sign a PIN agreement just as with your previous MEMBER CARD. Youth ages 12 to 18 do not need to have consent from a parent or guardian.

It’s a debit card. Your new card has both logos to highlight that you can make purchases using both payment networks. Purchases made in-store in Canada are debit transactions processed by Interac, whereas online and international transactions are processed by Mastercard.

The debit Mastercard is relatively new in Canada therefore some Canadian stores don’t yet accept the card for online transactions. A list of participating online Canadian retailers can be found here.

This list is updated periodically. Please note that if you attempt to use your card on a site that doesn’t accept debit Mastercard your transaction will be declined.

Getting a card

Beginning with August renewals, members will receive their new cards by mail upon renewal. All MEMBER CARDS will be replaced over the next three years. For security purposes, we recommend destroying your existing MEMBER CARD and removing it from your mobile wallet immediately upon receiving your new card.

Yes, when you receive your debit Mastercard, you’ll have to activate it by making a transaction using your chip and PIN number at a store or a credit union ATM.

This is a security feature; before making online purchases, you’ll have to activate your card by completing a chip and PIN transaction at a store, credit union ATM, or a Conexus branch.

Limits & fees

Yes, the same limits that applied to your previous MEMBER CARD also apply to your new debit Mastercard. If you’re unsure of what your limits are, please contact us at 1-800-667-7477 and we can share them with you.

The same fees that applied to your MEMBER CARD also apply to your new debit Mastercard, including withdrawals from a non-credit union ATM. Additionally, any international transactions will be charged a foreign transaction fee. For more information on transaction fees, click here.

Card usage

Many hotels will accept debit cards as payment including debit Mastercard, while others will not. Some hotels accept payment both ways, i.e., debit and credit cards. Whether or not a hotel will accept debit as payment varies from place to place as the policies around which cards are accepted are set by the hotel/merchant (not Conexus). It's always best to call ahead and ask before you make your reservation.

Please note that when making reservations the merchant may put a hold on the funds to guarantee your reservation and you must have enough in your account to cover the value of the hold. If you're unsure what the value of the hold is, you can ask the hotel/merchant to clarify, or your online banking will show you if there are any current holds on your account.

Your debit Mastercard is a debit card product. If you’re shopping at a store and you are prompted to choose between “debit” and “credit”, choose debit!

Yes, your new debit Mastercard will be set up to complete tap payments by default.

Yes, you can add your debit Mastercard to your mobile wallet on all supporting devices (Apple Pay, Google Pay and Samsung Pay).

If you're adding your card to your mobile wallet and you've had your new card for less than 30 days, you'll need to call us to complete the upload. However, if you're adding your new card to your Apple Wallet through the Conexus Mobile App it can be added immediately and contacting us is not required. When adding your card to your mobile wallet you can begin by manually entering the card details. Then when you're prompted to verify, you'll need to call us at 1-800-667-7477 and we will complete the process. This is done to provide extra security and protect your card against fraud.

Note: this only applies if you are adding your card to your mobile wallet and have had your card for less than 30 days. You will not need to contact us if you've had your card for 30 days or more. Once your new debit Mastercard has been uploaded to your mobile wallet, please remember to delete your old MEMBER CARD.

Return transactions for items bought online may take up to seven days to be credited to your account. The speed of your return depends on how quickly the store you purchased the item from processes it in their system.

Your debit Mastercard was designed with your safety in mind! The card number has been moved to the back of your card and stacked to discourage “shoulder surfing” while making in-store purchases.

Additionally, your debit Mastercard has both Mastercard’s Zero Liability and Interac Zero Liability protection for both your credit and debit transactions.

To familiarize yourself with the terms and conditions of Mastercard’s Zero Liability click here and for Interac Zero Liability, click here.

Visit online banking or the mobile app to Lock‘N’Block your card as soon as possible if you have transactions you didn’t authorize or if your card has been stolen. To report your card as lost or stolen or for assistance with other items, please call us at 1-800-667-7477.

When withdrawing money from an ATM outside of Canada, it won’t ask you to select an account (chequing vs. savings) and will default to your chequing account. If you don’t have sufficient funds in that account, the transaction will be declined.

Holds

When you make an online, pre-authorized or international purchase with your debit Mastercard a temporary hold in the amount of your transaction (or slightly higher) is placed on your account. The transaction will not be visible in your online banking under detail history or taken off your account balance until it’s posted, which will usually happen within 24-48 hours. Your available balance is the amount of money remaining in your account that you can spend.

It’s possible a hold for a larger dollar value than the actual purchase has been placed on your account. An example of when this might occur is when you’re paying at a gas pump and select “fill” instead of a specific dollar amount. A hold is placed on your account for the larger pre-authorized amount however you will only be charged the amount it took to fill your gas tank.

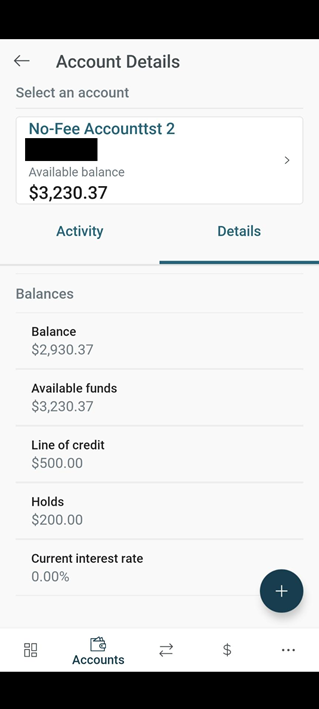

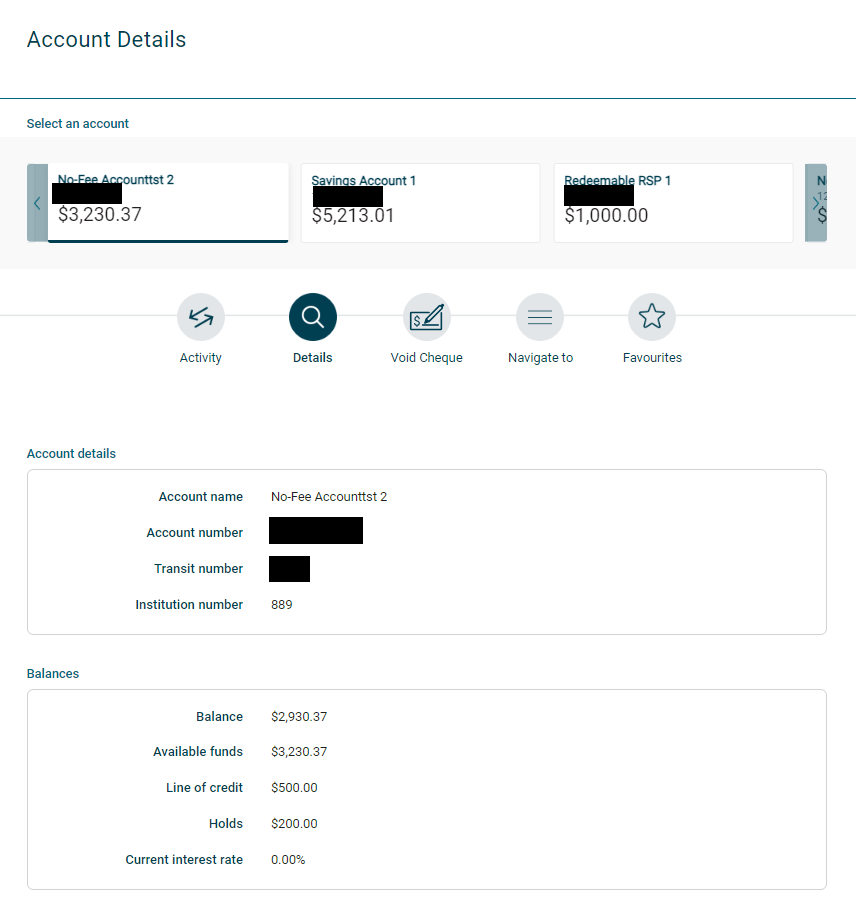

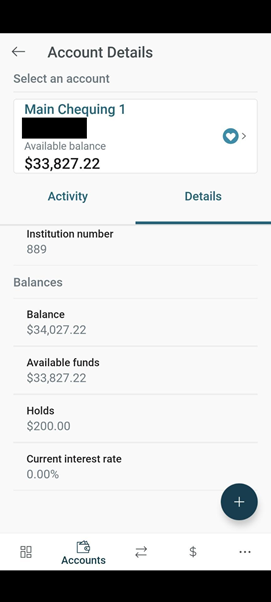

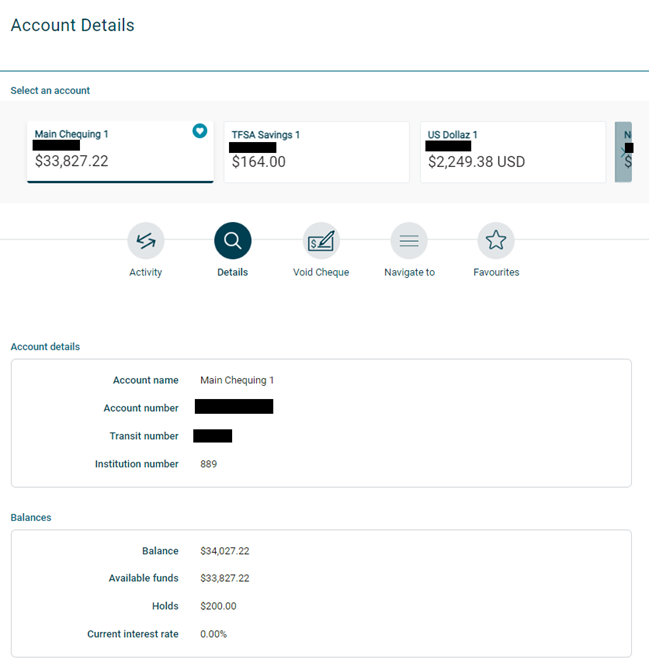

The example below shows a $200 hold for an online purchase of the same amount. The balance is the chequing account balance minus the hold. The available funds are the chequing account balance plus the $500 line of credit, minus the $200 hold.

With line of credit:

Without line of credit:

Replacing your debit Mastercard

Be sure to update any online accounts that have your old card number stored (ie. subscriptions, pre-authorized payments, websites, etc.). Please also remove your old card from your mobile wallet before adding your new card. When you receive your replacement card, you’ll have to activate it by making a transaction using your chip and PIN number at a store or a credit union ATM.

Note: if you are adding your new card to your Apple wallet and you’ve had it for less than 30 days, you will need to contact us at 1-800-667-7477 to complete the upload. Please refer to the "Can I add my debit Mastercard to my mobile wallet?" question under Card Usage.

To order a new debit Mastercard, call our Member Contact Centre at 1-800-667-7477. If you need a new card on the same day, you can get a permanent replacement by visiting your local branch, however this card will not have your same card number and will not have your name on it.

Please note that if you have your debit Mastercard reissued in the branch and request to receive another customized with your name on it in the mail, you will incur a card replacement fee. This also applies if you habitually lose your card and require more than one replacement. You can see a full list of transaction fees here.

Transaction disputes

If you have a dispute about an online purchase and haven’t been able to resolve it with the store/vendor, you may contact us. We must know of the dispute within 90 days of the date of purchase and the expected date of delivery. Disputes may take 8-12 weeks (about three months) to resolve.

Please note that if you made a purchase and the store has not provided you with the goods or services or the goods/services are not as described, we may be able to assist you. However, we will not be able to assist you in disputes about the quality or suitability of the purchase, nor can we help with any PIN transactions.

If you receive reimbursement from the store no further action can be taken by Conexus to claim a refund.

Terms & Conditions

1 It’s accepted online at any international online store that accepts Mastercard and participating online stores within Canada. For a list of Canadian stores, click here.