Money Advice for Life

More COVID-19 Scams to Monitor

During this pandemic, it’s not just your physical health at risk, your financial health may be as well. Throughout times of uncertainty we are seeing fraudsters launch sophisticated scams, exploiting public fears for targeted attacks – and we’re definitely in uncertain times. In addition to the scams we went over earlier, here are five more of the most prevalent COVID-19 scams we’re seeing used to attack people’s financial health and how you can protect yourself from being a victim.

You don’t think it can happen to you, until it does. We often think we will never fall victim to a scam, but it can happen to anyone. Fraud scams are under reported because victims are too embarrassed to admit they were exploited, and this perpetuates these crimes.

Fraud doesn’t discriminate and the tactics become more predatorial and sophisticated in health and economical crisis such as the COVID-19 pandemic. More than one million Canadians applied for Employment Insurance between March 16 – 22, 2020 because of COVID-19 job losses. The Government of Saskatchewan started introducing public health orders on March 17 that restricts social gatherings and business closure for non-essential services. People are more isolated than they’ve ever experienced, they’re feeling financially insecure, and their sense of normalcy has been disrupted. Criminals target these feelings and with the increase of information about COVID-19 in media coverage, on social media, and direct email, it can be difficult to know what is trustworthy. Let’s make sure you are aware and protected from the following scams:

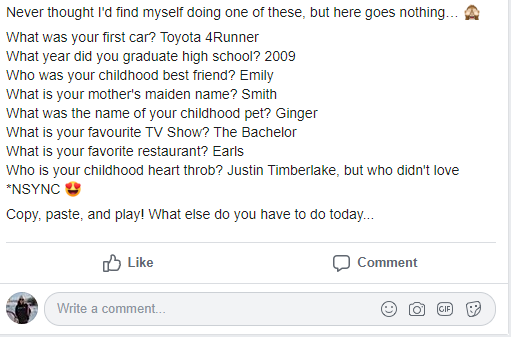

Social Media Questionnaires

Have you ever used your first car or your pet’s name as the answers to security questions? I know I have. Although harmless at first glance, these questionnaires are an easy way for a fraudster to gain access to your personal information to either answer your security questions or even pose as you to gain financial access.

You might be thinking, “I would never post this”, but someone you care about might or maybe has already. You may also think “I trust everyone in my friend list to not share my information.” They may be trustworthy, but it just takes one of them to get hacked and all of a sudden your personal information is in the hands of a fraudster.

Here’s how you can protect yourself:

DO NOT participate in these questionnaires and delete any old ones that you’ve posted. Spread the word to your friends and family as well.

Do not accept any friend requests from people you do not know and remove anyone that somehow slipped through the cracks.

Restrict the privacy settings on your social media accounts

Use secure passwords that include letters, numbers, and characters. Change your password routinely

Avoid security questions that could be easily guessed

CRA Text Scam

Do you know the warning signs of a scam? With all the uncertainty in the world right now, it’s easy to want to believe the best in people. This is what fraudsters are thriving off – vulnerability. This news story from CBC, warns Canadians of a text scam exploiting the new emergency relief program.

However, this isn’t the only scam going around. Some other scams to be alert for are text messages or emails from fraudsters impersonating the Canada Revenue Agency. This article outlines what to actually expect when the Canada Revenue Agency contacts you.

Here’s how you can protect yourself:

If it’s an unfamiliar phone number or email, don’t automatically trust the source

Look for spelling and grammatical errors in the text

Ask yourself “Does the URL look credible?” If you have ANY doubt, contact the company and fact check the message.

For more information on how to protect yourself, here the CRA outlines how to ‘Slam the Scam’.

Work From Home Scams

The provincial government recently warned against a work from home scam during the COVID-19 crisis. Fraudulent ads by companies offering opportunities to work from home as securities traders are appearing on social media. These ads promise that traders can keep a large percentage of the profits and they don’t need experience or a license. They only need to pay fees to the would-be traders.

If you’ve experienced job loss from COVID-19 and you’ve lost childcare, this would seem like a good way to replace your income – which is exactly why this tactic is being used. In Saskatchewan, anyone in the business of trading securities must be registered with Financial and Consumer Affairs Authority (FCAA), unless an exemption applies. The FCAA expects that similar scams will continue to increase during the COVID-19 crisis.

Fraudsters Posing as Financial Institutions

In times of uncertainty or struggle is often when individuals turn to their financial institution for advice, services or products to help them navigate their financial situation.

A text message scam has been circling around where fraudsters are posing as a financial institution, using scare tactics to try and gain access to your information.

As seen in this message below, someone impersonating Scotiabank has used a scare tactic to make you think your access has been disabled to get you to click the link. As we touched on before, here are some things you want to look out for:

Unfamiliar phone number

Spelling and grammatical errors

Unusual links

Here’s how you can protect yourself:

Don’t click any of the links in the message – go directly to your financial institution’s website through your web browser

Always log in to your account directly online or through your mobile app

Double check the source of the text – when using scare tactics people often just react, but in reality, you may not even have an account with Scotiabank

If something serious was happening to your account, your financial institution would definitely call you, not text you.

Exploiting Grocery Delivery for seniors

As we all take measures to social and physical distance ourselves, common tasks such as grocery shopping have become difficult, especially for some of the most vulnerable in our communities. Unfortunately, fraudsters are posing as helpful citizens offering to deliver groceries to seniors who are socially isolated or are physically unable. These scams ask for e-transfers or credit card numbers in advance with the grocery list. They’ll also ask for your address – not so they know where to deliver the groceries, but so that they can list it as the billing address when they charge the card. Disgusting, right?

Here’s how you can protect yourself:

Utilize delivery services offered directly through grocery stores/business in your community. Many grocery stores have started offering special shopping hours for seniors

Rely on friends and family to shop for you

Be alert and aware of other scams that exist right now

Have conversations with your parents and grandparents to educate them on how they can protect themselves

Remember, fraud does not start and end here – it’s important that you remain alert even as the COVID-19 pandemic comes to an end. If you have been targeted or have fallen victim to an attack, it’s nothing to be ashamed or embarrassed about. It can happen to anyone.